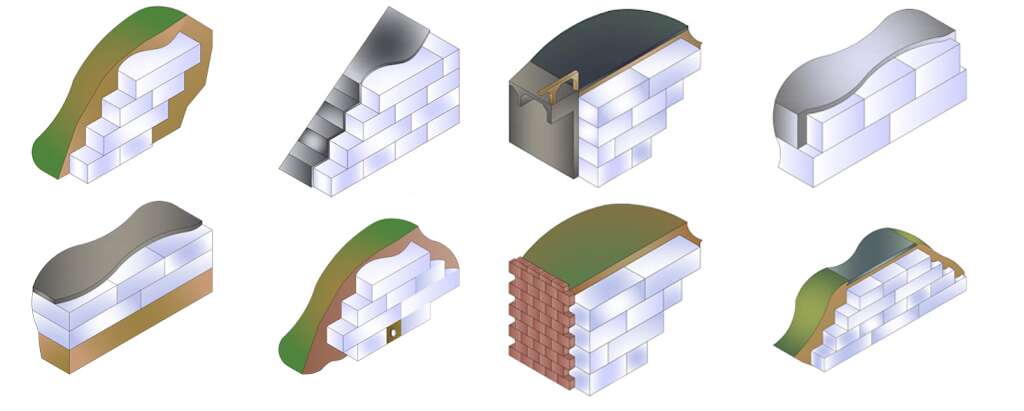

Weight matters when it comes to construction. Traditional fill materials like soil and gravel can add unnecessary stress to weak soils and lead to settling, shifting and costly repairs. That’s where Geofoam comes in. It’s a lightweight but strong material that’s changing the way engineers handle construction challenges. At Benchmark Foam, we manufacture high-quality Geofoam, […]

News & Articles

When it comes to choosing insulation, the debate between EPS (Expanded Polystyrene) and XPS (Extruded Polystyrene) is a big one. Both are made from polystyrene, but their differences in performance, cost and environmental impact can make or break a project. At Benchmark Foam, we know that the right insulation isn’t just about keeping heat in, […]

When storms rage, earthquakes shake the ground or temperatures swing wildly, buildings need more than just good looks. They need real strength. That’s where Stronghold Insulated Concrete Forms (ICFs) come in. Unlike traditional wood framing or even standard concrete construction, Stronghold ICF structures are built to stand firm when extreme weather strikes. From hurricane-force winds […]

At Benchmark Foam, we’ve seen firsthand how the right packaging can make or break a product’s journey from factory to customer. Cardboard and plastic have been standard packaging choices for years. However, molded EPS packaging can offer a better way. EPS is light but strong, saves money and can be recycled. The Problem with Traditional […]

Contractors face a tough choice when building on unstable ground: spend weeks (and a small fortune) moving heavy soil, or find a better way. That’s where Geofoam blocks shine. These lightweight yet sturdy EPS (expanded polystyrene) blocks are changing the game in construction, offering a simpler, faster, and more cost-effective solution for projects that need […]

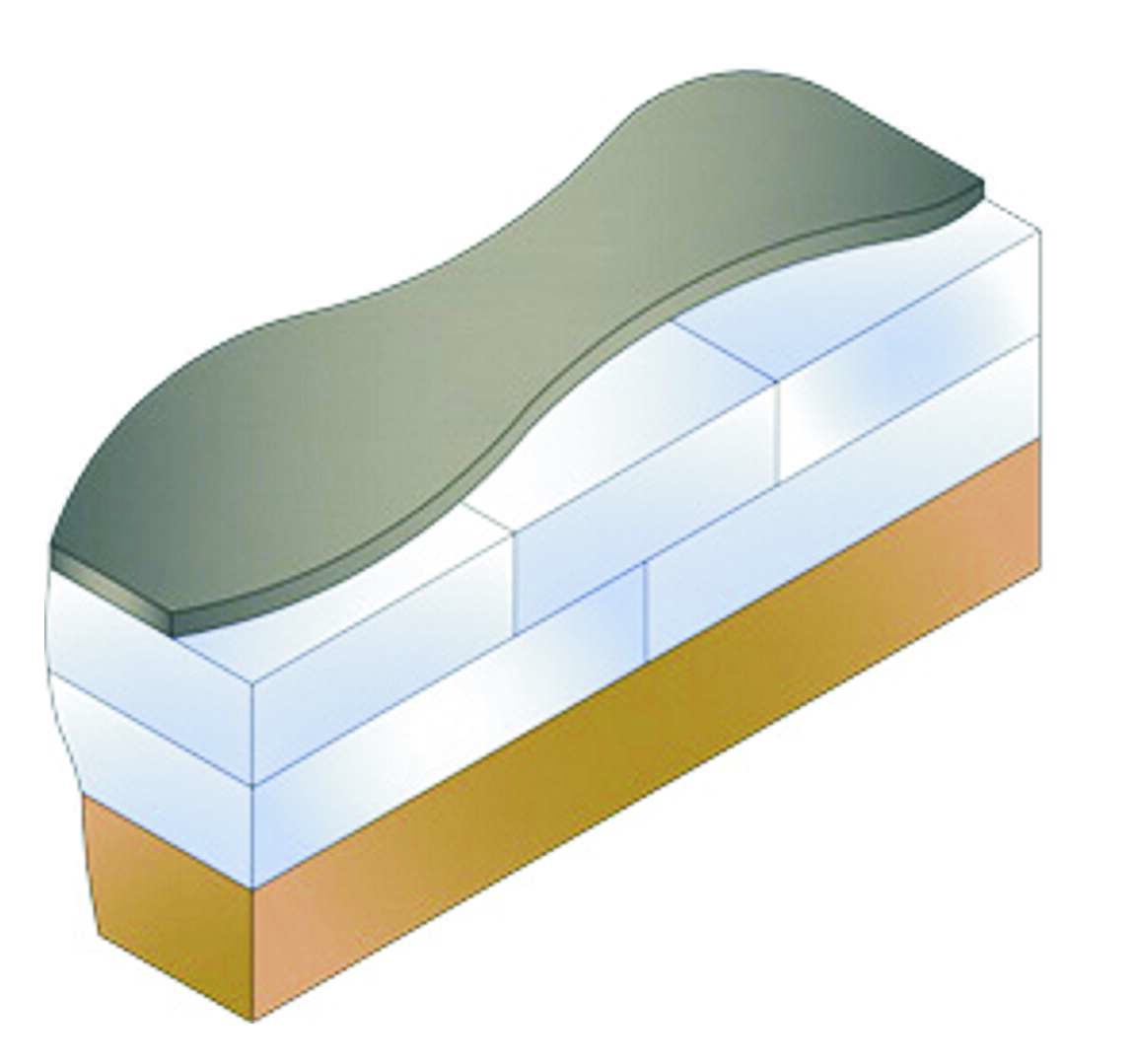

If you’re looking to keep buildings comfortable and energy-efficient, roof insulation is what you need. Among the many options available, EPS (expanded polystyrene) roof insulation stands out as a smart choice for both commercial and residential projects. Lightweight, durable and highly effective, EPS insulation helps regulate indoor temperatures while lowering cooling costs, all without breaking […]

Many companies look to expanded polystyrene (EPS) to protect their goods during shipment and storage due to its reliability. Lightweight yet incredibly strong, EPS packaging has become a go-to choice for industries ranging from electronics to pharmaceuticals. At Benchmark Foam, we’ve seen firsthand how EPS solutions improve product safety, cut costs and simplify logistics. Why […]

When it comes to building strong, energy-efficient structures, the materials and methods you choose make all the difference. For decades, traditional poured concrete has been the go-to for foundations and walls. But now, builders are turning to Stronghold ICF. It’s a smarter, more efficient way to construct durable, well-insulated buildings. So, what sets Stronghold ICF […]

When building roads and bridges, engineers face a constant challenge: how to create stable and long lasting structures without overloading weak soils or overburdening a budget. That’s where EPS Geofoam comes in. It’s a lightweight yet strong material that’s transforming infrastructure projects across the country. At Benchmark Foam, we manufacture high-quality expanded polystyrene (EPS) Geofoam, […]

When it comes to roofing insulation, not all rigid boards are created equal. The right roofing insulation board can make a significant difference in energy efficiency, comfort and even the lifespan of your roof. But with so many options available, varying in thickness, material and thermal performance, how do you choose the best one for […]